In data: US retailers urged to focus on value to boost holiday sales

IN DATA: US RETAILERS URGED TO FOCUS ON VALUE TO BOOST HOLIDAY SALES

S&P Global

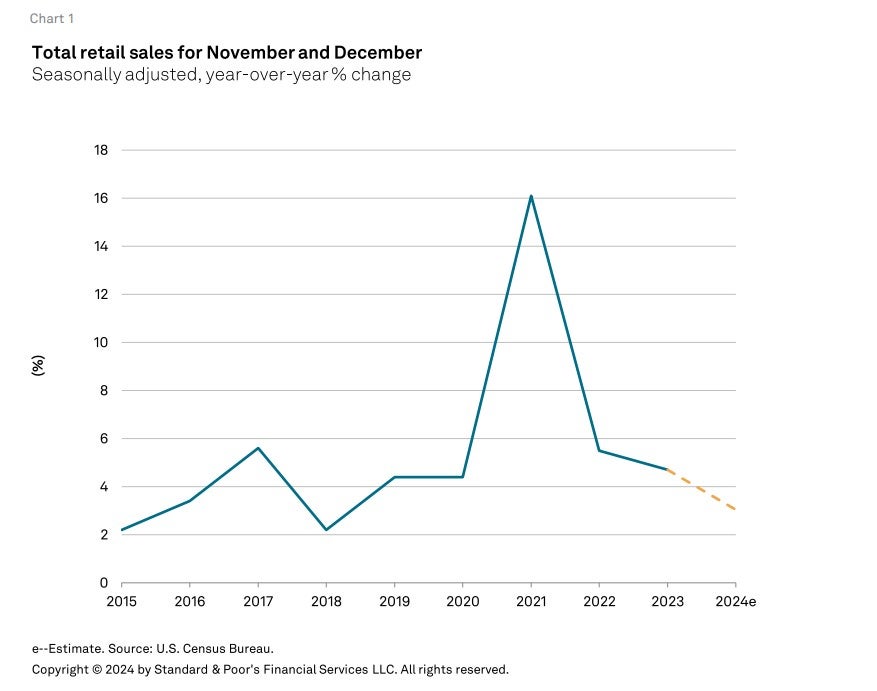

Ratings expects US holiday sales growth to slow to about 3% in 2024 from 4.7%

last year and suggests boosting value will be key to US retailer success.

US financial information firm S&P Global says its outlook is influenced by waning but persistent inflation that has pressured US household budgets.

Additionally, it suggests the late

Thanksgiving holiday will result in five fewer shopping days than last year,

which may weigh on sales.

However, it notes that a loosening but resilient labour market and further anticipated interest rate cuts support consumer confidence levels.

Moreover, many retailers have pulled ahead inventory orders, positioning themselves well for any potential supply-chain disruptions.

S&P Global predicts that value perception will separate retailers, and it expects those with the right merchandise at the right price will emerge as winners this holiday season.

Retailers that are exposed to discretionary spending are said to be nearly 1.5 times as likely to face a downgrade within the next one to two years than retailers whose sales rely on more stable nondiscretionary spending

It also expects retailers’ margins to remain steady because of broad cost-savings initiatives implemented throughout the year despite increased promotional activity.

The company suggests not all retail sectors will perform equally well. It expects value retailers that cater to the more resilient middle and higher income consumer will fare better due to increased foot traffic from value-conscious consumers.

Similarly, big box retailers like Walmart Inc. and Target Corp., with their ability to effectively communicate and deliver value to consumers, will also likely perform well as consumers seek ways to stretch their budgets. We expect other sectors, such as department stores and apparel retailers, will rely on higher discounts to increase traffic and manage inventory.

Furthermore, soft demand in specialty categories like consumer electronics and home furnishings will also necessitate promotional activity to spark demand.

Ultimately, issuers that have the financial flexibility to compete on price and convenience will continue to fare better in our view.

It points out the September retail sales data serves as an early indicator of holiday shopping trends and suggests that the 2024 holiday season may be successful if retailers focus on improving their value propositions.

Earlier this week the US Retail Monitor suggested October 2024 results signalled signs of resilience and consumers moving past port strike concerns.

By Just Style