US import 2024 data signals complex year ahead for fashion sourcing

US IMPORT 2024 DATA SIGNALS COMPLEX YEAR AHEAD FOR FASHION SOURCING

2024

was anything but easy for US fashion sourcing executives and their global

suppliers with annual trade data revealing a complicated sourcing environment

that could continue in 2025.

How

did US fashion imports perform in 2024 against the backdrop of ongoing

uncertainties in the US economy and escalating geopolitical tensions?

Key learnings from US fashion sourcing’s main trends in 2024

Using the latest annual trade data released by the Office of Textiles and Apparel (OTEXA), US International Trade Commission (USITC), and other US government agencies, Just Style identifies the key trends in US apparel trade and sourcing for 2024 to shed light on the sourcing outlook in 2025.

Trend 1: US fashion sourcing volume slightly increased in 2024

The data shows an improved US consumer clothing spend, however consumers seem to purchase fewer new clothing today than in the past.

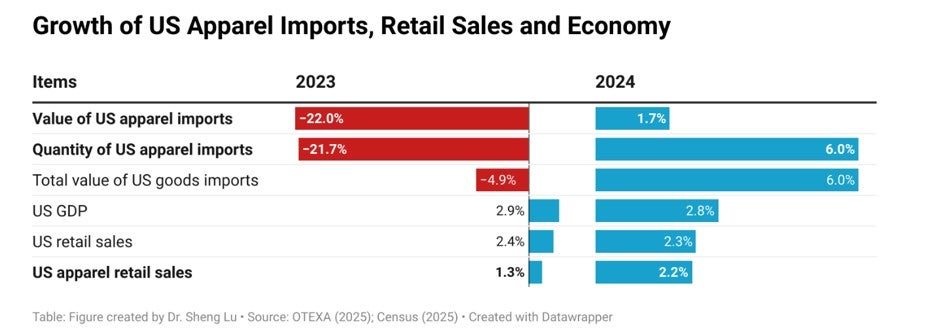

As a “buyer-driven” industry, the volume of US apparel imports is highly dependent on consumers’ spending on clothing. In 2024, thanks to relatively eased inflation in the US economy and renewed consumer confidence in their household financial outlook, US apparel retail sales went up 2.2%, a notable rise from only 1.3% a year earlier.

Correspondingly, US apparel imports totalled $79.3bn in 2024, up 1.7% from 2023. In quantity, these imports amounted to approximately 25.8bn square metre equivalents (SME) in total, a 6.0% increase from 2023.

Despite the growth, it is important to note that in absolute terms, the volume of US apparel imports in 2024 was still more than 20% lower than its peak in 2022 and about 5% lower than in 2019, before the pandemic.

Similarly, in 2024, only about 4.25% of US retail sales (NAICS 44) came from “clothing and clothing accessories stores” (NAICS 448), a record low in decades. This result reminds us that consumers’ shifting clothing spending habits, such as the growing popularity of the secondhand and resale market, could continue to affect import demand and sourcing volume in the new year ahead.

Trend 2: Sourcing diversification remained, but Asia became a more dominant sourcing base in 2024

According to the latest Fashion Industry Benchmarking Study released by the US Fashion Industry Association (USFIA), a record-high percentage of surveyed companies reported sourcing from more than 10 countries in 2024. Likewise, respondents indicated that they hope to leverage sourcing diversification to mitigate growing market risks, including but not limited to various social and environmental compliance issues, supply chain disruptions, and rising geopolitical tensions.

The official trade data also reflects fashion companies’ ongoing sourcing diversification strategies. For example, the Herfindahl–Hirschman Index (HHI), a commonly used measure of market concentration, remained at a historical low of around 0.103 in 2024, suggesting that US apparel imports were sourced from highly diverse locations overall.

However, interestingly, in the context of sourcing diversification, trade data shows that as many as 72.7% of US apparel imports came from Asia in 2024, up from 71.6% between 2022 and 2023.

Notably, in terms of value, the CR3 index (i.e., the combined market share of the top three suppliers — China, Vietnam, and Bangladesh) slightly increased from 48.5% in 2023 to 49.0% in 2024. Even more strikingly, the CR5 index excluding China (i.e., the total market share of Vietnam, Bangladesh, Indonesia, India, and Cambodia) reached a new high of 44.2% in 2024, compared to about 37.1% in 2019 before the pandemic.

In other words, given the constraints in production capacity, many US fashion companies are choosing to diversify sourcing within Asia rather than moving orders to other regions.

Trend 3: US apparel imports included a wider range of product categories

This reflected consumers’ increasing expectations for clothing to be personalised, trendy and fast-changing.

Specifically, calculated at the 6-digit HS code level, the product diversification index of US apparel imports from the world (HS Chapters 61 and 62) decreased from 3.13 in 2022 to only 2.8 in 2024. This result indicated that US fashion imports now covered a greater variety of products instead of focusing on any specific category.

Industry sources also show that there was a notable increase in the array of newly launched products to the value and mass segments of the US retail market in 2024 from a year ago. This was possibly due to increased demand for budget clothing items among consumers struggling with high living costs and inflation.

On the other hand, many leading US apparel-supplying countries, such as China, Vietnam, Bangladesh, India, and members of CAFTA-DR, also improved their product diversification between 2022 and 2024.

In a fast-paced and unpredictable US fashion market, being able to provide a wide range of products offers a unique competitive advantage as a preferred sourcing base by US fashion companies.

Trend 4: Consumers’ growing demand for sustainable products affected fashion sourcing strategies

US apparel imports in 2024 included more cotton apparel and fewer of those made from man-made fiber (MMF), which was a reversal of the trend since 2015.

Specifically, measured in quantity, cotton apparel (OTEXA category 31) accounted for 38.5% of total US apparel imports in 2024, an increase from 37.8% in 2023. In comparison, man-made fibre (MMF) apparel accounted for 57.9% of total US apparel imports in 2024, a notable decrease from 59.0% a year ago. This shift could be attributed to US consumers’ growing awareness of the environmental controversies associated with MMF fibres and fashion companies’ increasing usage of natural and eco-friendly fibre in clothing.

Additionally, the 2024 USFIA benchmarking study found that over 60% of surveyed US fashion companies planned to invest more resources to support “developing or sourcing products using recycled or sustainable textile materials” in 2024 in response to consumers’ growing calls for sustainable apparel products.

Aligned with the findings, tracking the websites of leading US fashion companies reveals that a significantly higher number of clothing items for sale in 2024 explicitly mentioned sustainability-related keywords compared to the previous year.

The most frequently mentioned keywords included “regenerative” (up 300%), “textile waste” (up 200%), “planet-friendly” (up 100%), “recycled” (up 100%), and “low impact” (up 46%).

Besides their environmental advantages, these “sustainable apparel” products may create new sourcing diversification opportunities for US fashion companies, considering the unique supply chain and production requirements needed to produce them.

Asia dominated US apparel shipments in November 2024 with Bangladesh enjoying the largest volume increase, while Mexico was the only top 10 supplier to suffer a decline.

By Just Style