US brand strategies for sourcing sustainable preferred fibre fashion

US BRAND STRATEGIES FOR SOURCING SUSTAINABLE PREFERRED FIBRE FASHION

Sourcing clothing made with preferred fibres provides US fashion companies with new opportunities to diversify their existing sourcing base and explore emerging sourcing destinations outside of Asia.

As consumers become increasingly aware of the environmental impact of apparel production and consumption, a growing number of US fashion companies have announced the intention to use “preferred sustainable fibres” (or “preferred fibres”) in their apparel products.

Most discussions on preferred fibres currently focus on the technical aspects of making them, such as how to mechanically or chemically recycle textiles or reduce water usage. Other studies examined consumers’ preferences toward “sustainable apparel” and their related shopping behaviours. However, as a notable gap, it remains unclear where sustainable apparel using preferred fibre can be sourced from, and the sourcing implications of using preferred fibre in apparel products.

This article explores US fashion companies’ sourcing strategies for sustainable clothing that incorporates preferred fibres. Specifically, company-level and product-level data is used to identify the growing trend of preferred fibre usage and the respective strengths of Asia, Europe, and America — three major apparel-producing regions — in supplying such products. The results provide new insights into the business aspect of preferred fibre usage and assist fashion companies interested in sourcing apparel products that utilise sustainable preferred fibres in identifying related opportunities and potential challenges.

What are “preferred fibres”?

To gain practical knowledge about “preferred fibres” and their scope and definitions, several leading US fashion companies’ websites and ESG reports were examined.

The results show that:

First, while US fashion companies define “preferred fibres” in varying languages, they generally adopt definitions that align with well-known external standards and sustainability frameworks. For example, Levi’s, Gap Inc., and PVH adopted the “preferred fibres” definition developed by the Textile Exchange’s Preferred Fibre and Materials Matrix and Cascale’s (formerly the Sustainable Apparel Coalition’s) Higg Materials Sustainability Index. Meanwhile, other retailers, such as Macy’s, emphasise that preferred fibres should be materials that are “certified” to demonstrate improvement in environmental performance over the status quo. As “greenwashing” can be a concern among consumers, leveraging third-party standards and certifications helps build trust and credibility regarding preferred fibre usage and sustainability claims of the products.

Second, no specific “preferred fibre” seems to dominate the market. Instead, US fashion companies consider “preferred fibres” to include various choices. For example, companies such as Patagonia and Levi’s often prefer natural fibres, particularly those produced through regenerative agriculture or cultivated without chemicals. Others adopt synthetic fibres, such as recycled polyester and nylon, which potentially could help reduce textile waste and promote a circular economy. For example, Gap Inc. aims for 45% of its polyester to come from recycled sources by 2025, and VF Corporation already sources 50% of its polyester from recycled materials.

Third, when selecting preferred fibres, fashion companies often balance multiple factors, including but not limited to environmental impacts, product quality, and production costs. For example, recycled fibres have gained increasing interest among fashion companies due to their relatively balanced affordability, broad availability, and consumer recognition.

At the same time, companies often acknowledge the limitations of using certain preferred fibres, such as reduced texture durability and performance, in addition to their higher production costs. This also suggests that the definition and scope of “preferred fibres” will continue to evolve alongside technological advancements and company-led business innovations.

Sourcing base for sustainable apparel using preferred fibre

We tracked about 50 leading US apparel brands and retailers’ websites, as well as their apparel product offers from January 2023 to April 2025 (latest available), to gain first-hand insights into their sourcing practices for clothing using sustainable preferred fibres.

Many of these companies were influential players on the S&P 500 list. The products tracked need to meet three criteria.

One is that they highlighted sustainability features by using at least one of the following keywords in the product description: “low environmental impact,” “textile waste,” and “eco-friendly.”

Second, the clothing item explicitly mentioned using one of the following preferred fibres: “recycled,” “organic,” “regenerative,” or “biodegradable.”

Additionally, we focused on products sourced from three regions of the world, given their dominant role in supplying most apparel consumed in the US market and known strengths in sustainable apparel production:

- Asia, including China, Vietnam, Bangladesh, India, Indonesia, and Cambodia

- EU, including UK, Germany, France, Italy, Spain, Poland, Romania, Turkey, and Portugal

- America, including the US, Mexico, Honduras, El Salvador, Guatemala, Nicaragua, Dominican Republic

A total of 243,000 Stock Keeping Units (SKUs) of products that met the criteria were captured. Each item’s detailed product information, such as its country of origin, fibre content, and assortment features, was analysed.

Several patterns are interesting to note:

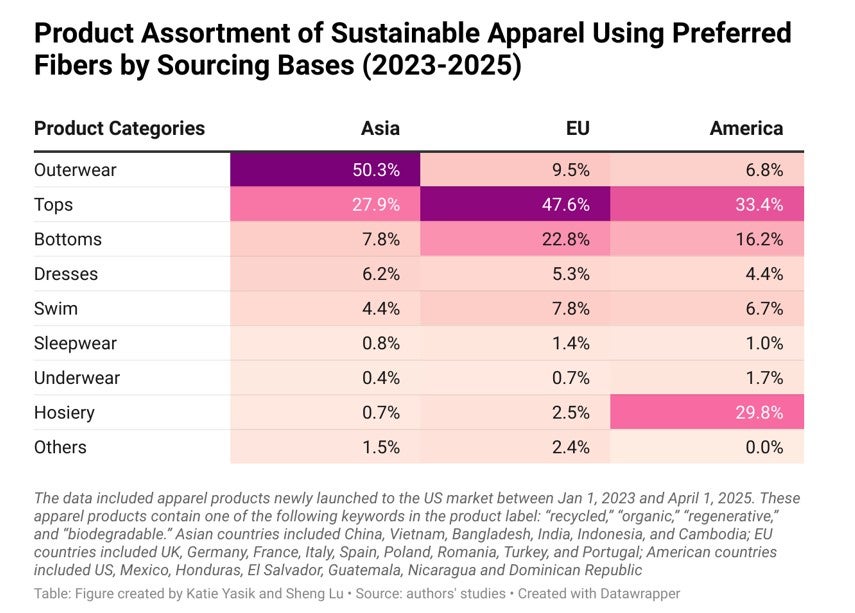

First, sustainable clothing made from preferred fibres sourced from Asia, the EU, and America each exhibited a distinct focus on product categories. The results show that US fashion companies already source a wide range of clothing products that contain preferred fibres, from tops, bottoms, dresses, and swimwear, to underwear. By SKU count, nearly half of these products sold in the US retail market between January 2023 and April 2025 were made in the EU, followed by Asia (about 35%), and the remaining 11% came from countries in the Americas.

In other words, sourcing clothing using preferred fibres has somewhat made US fashion companies less dependent on Asia and provided an opportunity to develop a more diversified sourcing base worldwide.

Specifically, among clothing items made with preferred fibres, Asian countries played a dominant role in supplying outerwear and tops. This pattern revealed Asian suppliers’ competitive advantage in producing relatively more sophisticated garments, thanks to the vast manufacturing capability and the availability of a skilled labour force.

In comparison, most clothing containing preferred fibres sourced from the EU consisted of tops, bottoms, and swimwear, which aligned with the region’s capacity for making various clothing categories.

Meanwhile, the United States and other countries in the Americas appeared to specialise more in relatively simple hosiery items, such as socks. This pattern may be attributed to the automated production process of making socks, allowing “Made in the USA” to remain cost-neutral despite the higher wage level.

Second, the sourcing base affected the assortment of sustainable apparel made with preferred fibres.

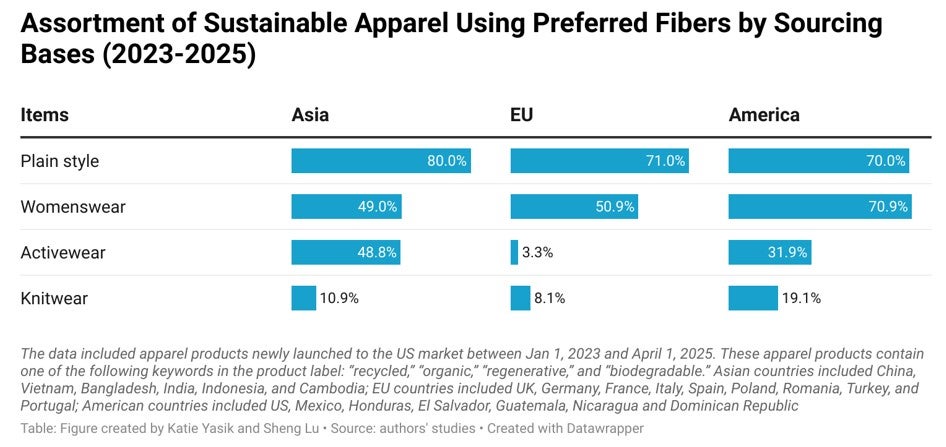

On the one hand, regardless of sourcing destinations, most clothing made with preferred fibres for sale in the US retail market was plain-looking and did not adopt specific design patterns like floral, graphic, or checks. This result revealed the additional technical complexity of balancing a clothing item’s aesthetic outlook with the physical properties of preferred fibres, which often degrade the quality of fabrics.

On the other hand, affected by each region’s production capacity, imports from Asia, the EU, and the Americas displayed varying assortment focus. For example, apparel imports from Asia showed a more substantial presence in activewear and woven clothing for both menswear and womenswear.

In comparison, imports from EU countries rarely included activewear, although they primarily consisted of woven apparel. Additionally, clothing made in the Americas was mostly womenswear and included significantly more knitwear, such as socks.

Overall, the results indicate that, regardless of specific preferred fibre choices, a region’s apparel production capabilities still influence the types of finished garments that US fashion companies source from that region.

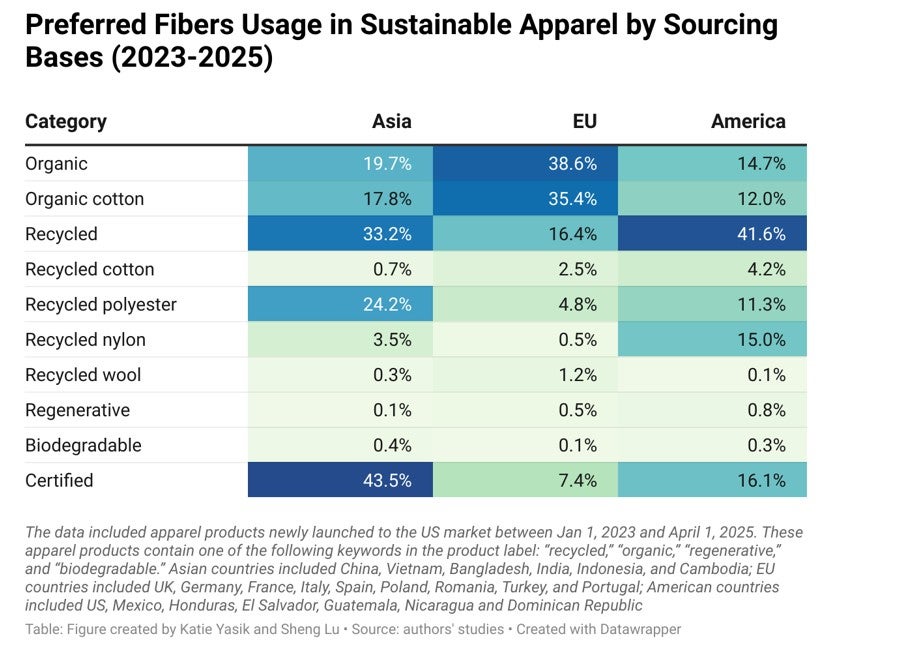

Third, each sourcing base seems to have its preferred fibre focus. Specifically, clothing sourced from Asia was far more likely to use recycled polyester than clothing made in the EU and the Americas. Industry sources indicate that several Asian countries, such as India and Vietnam, have made substantial investments in recent years to expand their recycled polyester manufacturing capability, especially from plastic bottles. Organic cotton was also commonly used in clothing made by Asian countries.

Moreover, for whatever reason, clothing made in Asia that contained preferred fibres had a relatively higher percentage claiming to be “certified.” The most popular programmes included OEKO-TEX Standard, GRS (Global Recycled Standard), and GOT (Global Organic Textile) standards.

In comparison, clothing made in the EU had the highest percentage using organic fibres but the lowest percentage of recycled fibres among the three regions.

EU-based environmental regulations could be important factors behind the phenomenon. For example, the EU’s Common Agricultural Policy and recently implemented organic product labelling requirements provide strong incentives for companies to adopt organic fibres such as cotton. At the same time, other EU legislation emphasises textile-to-textile recycling and tends to discourage the use of plastic-based recycled materials, such as recycled polyester in garments.

Furthermore, clothing made in the Americas had the highest percentage of various recycled materials, such as recycled polyester, recycled nylon, and recycled cotton. This result highlighted the strong interest of the US textile industry in leveraging its technological strengths and more advanced textile waste collection and sorting capabilities than the rest of the world in supplying recycled textile materials for garment production.

Additionally, sourcing clothing made from “regenerative” or “biodegradable” fibres seems to remain a challenge, as none of the three regions examined have demonstrated particular strengths or scale in adopting these fibres in clothing.

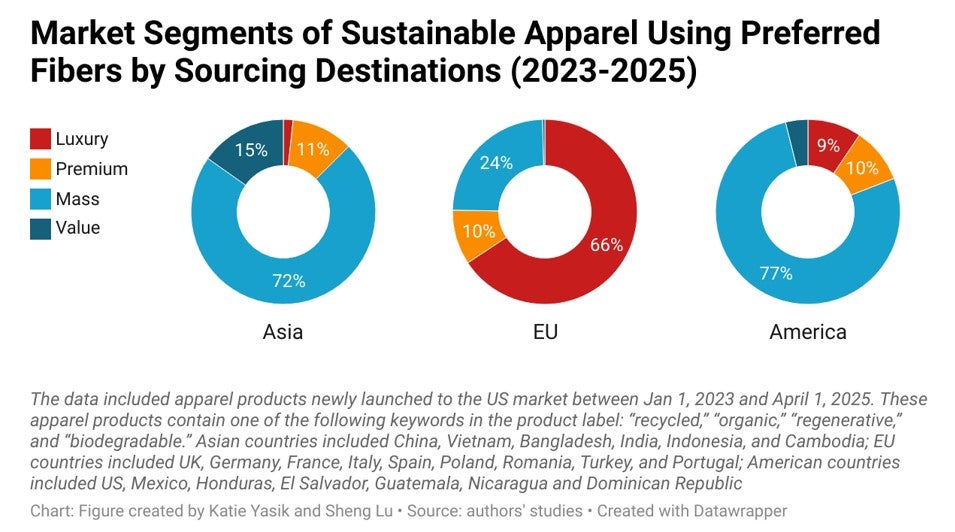

Last but not least, US fashion companies sourced clothing from Asia, the EU, and the Americas to target different market segments. For instance, reflecting the production cost structure and the country-of-origin effect, over 80% of clothing containing preferred fibres sourced from Asia and the Americas catered to the mass and value market segments. In contrast, more than 76% of such clothing sourced from EU countries was positioned in the luxury or premium segments of the US retail market. Nevertheless, the results indicate that clothing made with preferred fibres is not limited to the high-end market — instead, US retailers leveraged such products to appeal to consumers across all market segments.

In conclusion, this study revealed US fashion companies’ nuanced sourcing strategy for clothing made with preferred fibres. It is encouraging to see that suppliers in Asia, the EU, and the Americas have been able to offer a wide range of sourcing options for such products regarding fibre types, product assortments, and price points. The study’s findings also suggest that, in addition to the potential sustainability benefits, sourcing clothing made with preferred fibres provides US fashion companies with new opportunities to diversify their existing sourcing base and explore emerging sourcing destinations, particularly outside of Asia.

Moreover, fashion companies, suppliers, and other stakeholders should pay closer attention to potential emerging issues such as labour conditions, supply chain traceability, and long-term environmental impacts related to the increased use of preferred fibres. Ultimately, the growing adoption of preferred fibres presents a promising new pathway toward more ethical and sustainable apparel production and a new force shaping the future landscape of apparel sourcing.

By Just Style